Grow your knowledge – and your confidence.

Achieving financial wellness can feel like overcoming a mountain – but both are achieved one step at a time. We’re here to help guide you on the path to financial wellness. No matter your current financial situation, we have the tools and information to help you conquer the mountain and reach financial success.

What are you worried about?1

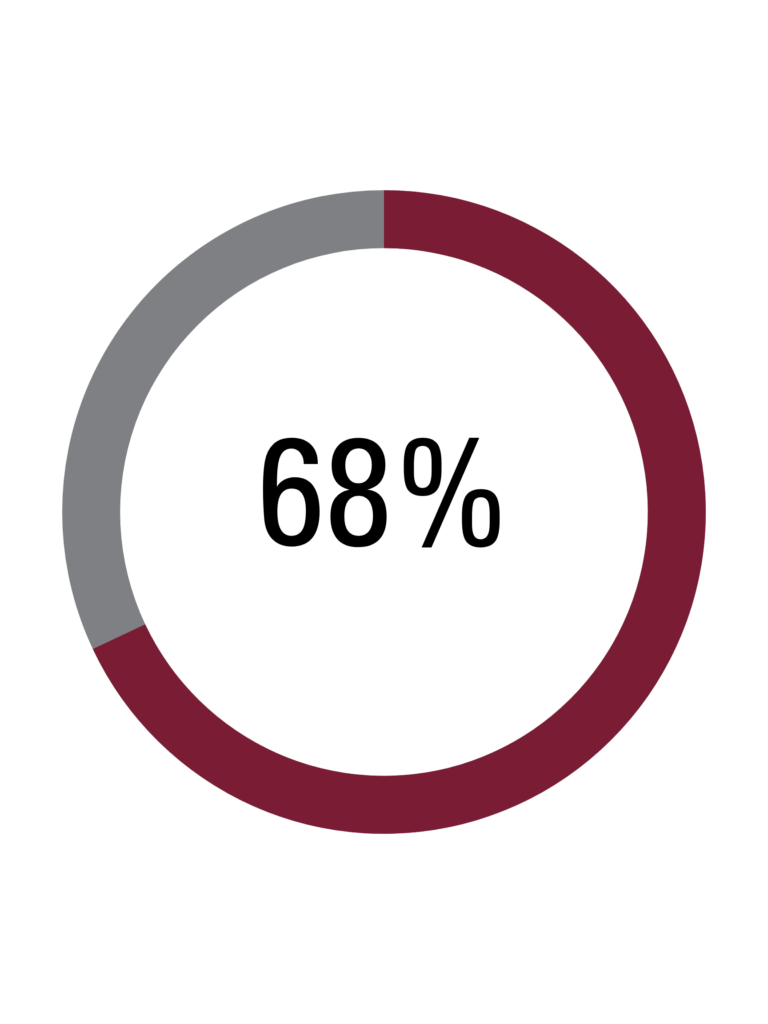

Not having enough money to retire.

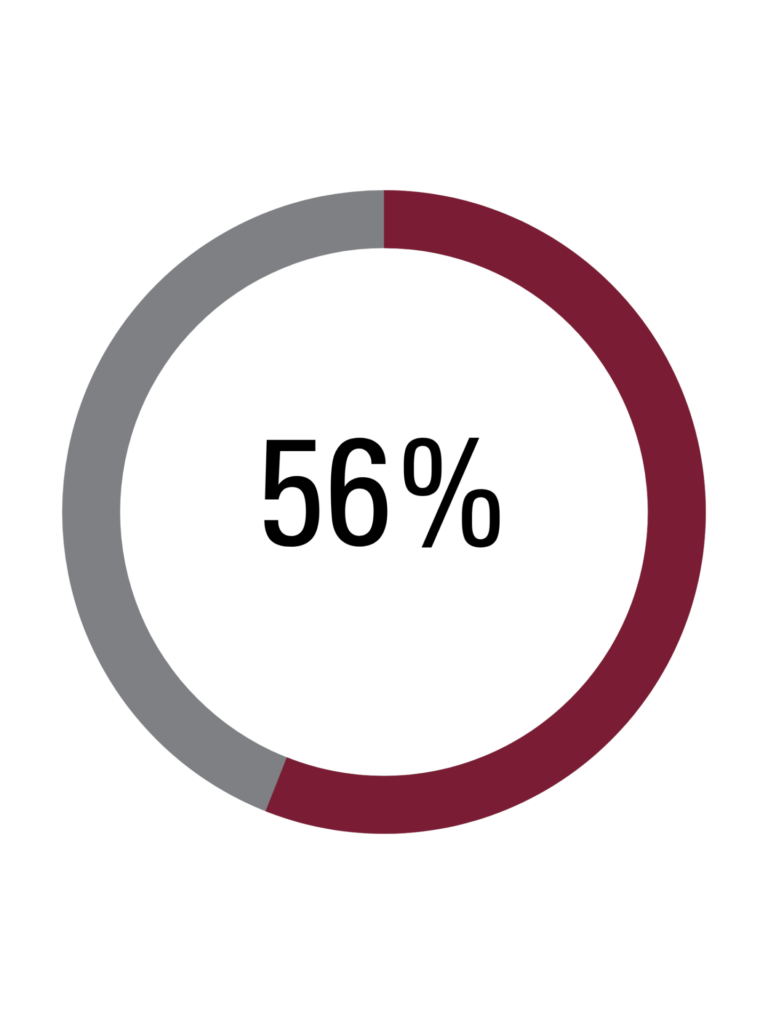

Keeping up with the cost of living.

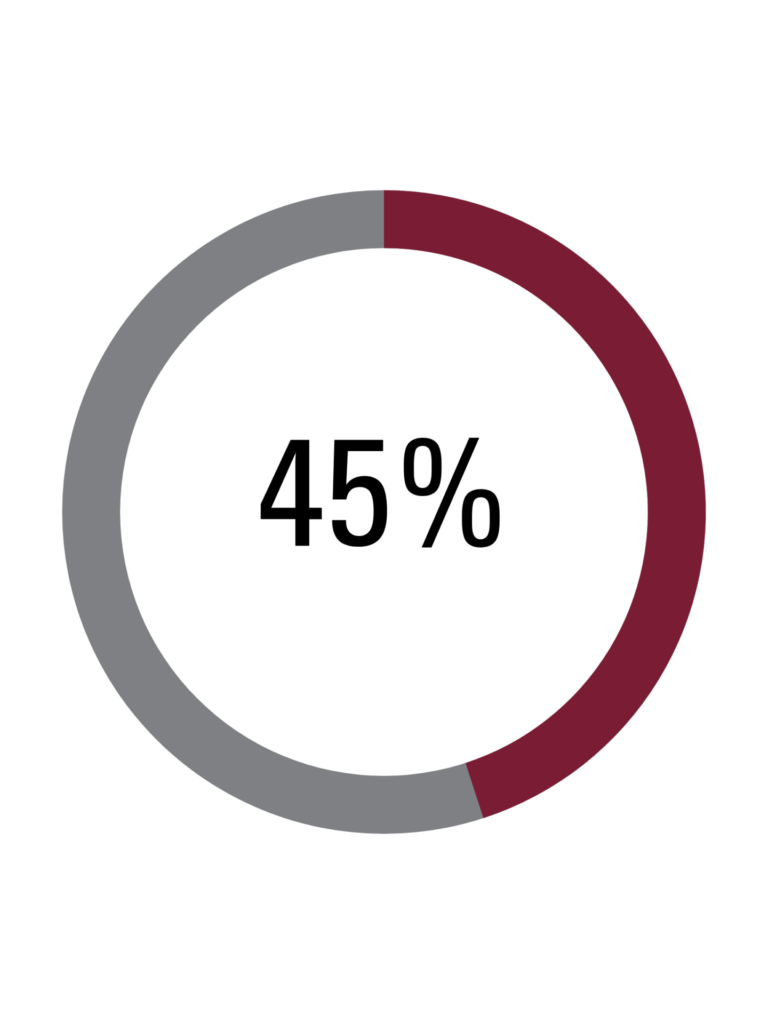

Managing debt.

1 https://www.capitalone.com/about/newsroom/mind-over-money-survey/

Turn your worries into wellness.

We have created an engaging Get Well Classroom to mentor you on all things financial. From budget balancing and savings to loans and retirement planning, you’ll find easy-to-use information, tools, and resources to take you to the top of the class.

Your Personal Toolbox

Learn where to start and how to plan for what’s next.

Smart Tools for Business

Boost your employee benefits with Southern@Work. This robust resource includes customized financial wellness training for your employees, as well as a variety of features that help reduce both financial and workplace stress.

Make the most of your budget with BaZing®, including rich discounts, savings, and surprising features to keep you on the road to financial wellness.*

Let's talk.

Please give us a call at 1.855.275.7226 or fill out the form below, and we’ll be in touch soon to answer your questions and determine the right solutions for you.