Your business may be considered “small” – but to you, everything about it is a big deal. That includes your small business’s financial […]

In The News

Banks invest heavily in measures to protect their customers and prevent systemwide cyberattacks. But is mobile banking actually secure?

Your years in high school are meant to set a solid foundation of learning, preparing you for your what’s next – whether it’s […]

Southern Bank of Mount Olive is proud to once again be rated 5-stars by BauerFinancial.

In 2022 alone, nearly 70,000 people reported falling victim to romance scams. Southern Bank can help victims navigate the complex process of reporting and recovery.

Learn to safeguard against deceptive pop-ups and protect yourself from fraud.

Southern Bank of Mount Olive has been recognized as the Community Bank of the Year by the NC Rural Center.

NEWS RELEASE For Immediate ReleaseApril 1, 2024 Contact: David L. Sauls, JrSouthern BancShares (N.C.), Inc.(919) 658-7013 MOUNT OLIVE, N.C.—On January 16, 2024, the Board […]

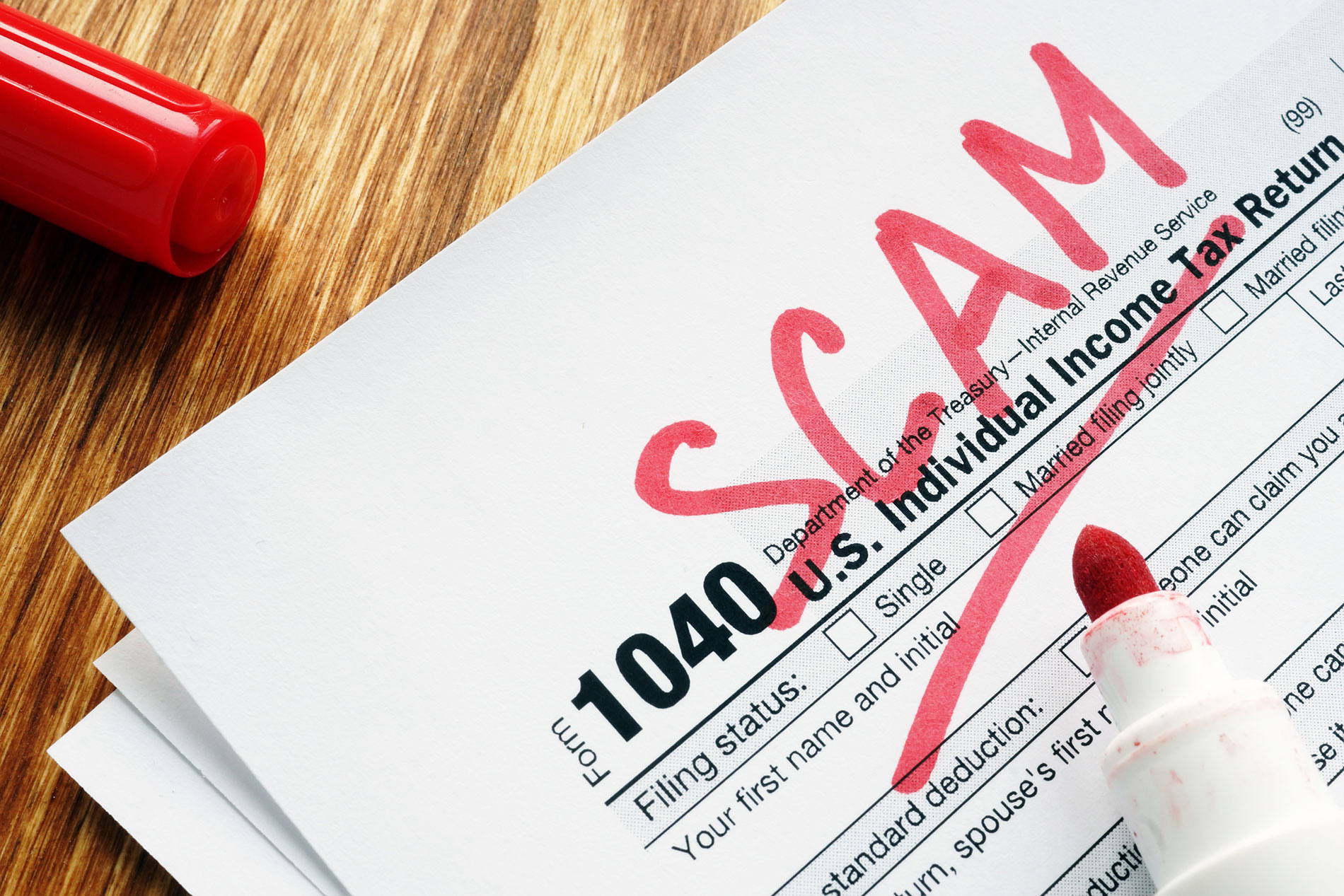

As you file your taxes, be on the lookout for potential tax scams. Learn more about identifying tax scams.

The holiday season is officially upon us — and while it’s a time of joy and celebration, it’s also a prime season for fraudsters seeking to exploit unsuspecting consumers.